As marijuana continues to expand the number of places where it is legal, some investors are excited about the profit potential for the cannabis industry. Total legal cannabis sales are expected to grow 16 percent a year and reach $43 billion by 2025, according to cannabis research firm New Frontier Data. Medical benefits and the growing use of products tied to cannabidiol, or CBD, make the cannabis industry ripe for continued growth.

While still illegal at the federal level, many states have moved to legalize marijuana in recent years, with the drug being fully legal in 19 states and Washington, D.C. as of 2021.

The growth potential is enticing, but there are risks to watch out for. Here are some key things to consider before investing in cannabis.

Any investment in a company or industry will ultimately depend on the profits those companies are able to deliver to shareholders. The cannabis industry is no different, but there are some reasons to be excited if you’re a potential investor.

Once you’ve decided whether investing in the cannabis industry makes sense for you, there are a few different ways to actually invest — many of which are accessible through your preferred online broker or favorite investment app.

One way to participate in the cannabis industry is by purchasing the stock of companies with ties to marijuana. Cresco Labs (CRLBF) is involved in growing, manufacturing and distributing cannabis-related products for consumers and currently operates in 10 states. But potential investors should be aware that the company failed to generate net income for shareholders in each of the past three years. The stock trades over-the-counter, or OTC.

Tilray (TLRY) is another company that sells consumer products related to cannabis as well as hemp-based foods and alcoholic beverages. The company, which trades on the Nasdaq, has a current market value of about $6 billion, but generated a net loss in each of its last two years.

Curaleaf Holdings (CURLF) and Green Thumb Industries (GTII) are two other stocks in the cannabis industry that are relatively large, with each carrying market values above $5 billion, but Curaleaf trades OTC and Green Thumb trades in Canada. GrowGeneration Corp. (GRWG) is listed on the Nasdaq and was worth $1.8 billion as of September 2021.

ETFs are another way to invest in the cannabis industry without having to pick individual companies, but be careful not to pay too much in fees.

One of the most popular cannabis ETFs is the ETFMG Alternative Harvest ETF (MJ), which holds shares in about 32 companies and is designed to track the performance of companies within the cannabis ecosystem. As of September 2021, the fund’s largest positions were in Canopy Growth Corp. (CGC) and Tilray (TLRY), with those two holdings making up about 15 percent of the fund’s assets. Investors in the ETF will pay an annual expense ratio of 0.75 percent, significantly higher than what a typical stock index fund would charge.

Another option is the Horizons U.S. Marijuana Index ETF (HMUS), which began trading in April 2019. This ETF holds shares in U.S. companies and comes with a hefty expense ratio of 0.85 percent. It tracks the performance of the U.S. Marijuana Companies Index. One thing to note, the ETF trades in Canada and is therefore quoted in Canadian dollars. It’s relatively small with about CA$30 million in assets as of September 2021.

Because marijuana is still illegal at the federal level, most banks are unable or unwilling to provide financing to the cannabis industry. As companies in the industry look to raise funds, many are turning to non-traditional sources such as real estate investment trusts, or REITs. Cannabis companies are able to engage in certain types of deals, such as a sale-leaseback transaction, where they sell their real estate to a REIT and immediately lease it back at an agreed upon price. This is one way for companies to get capital outside traditional banking.

One cannabis REIT to consider is Innovative Industrial Properties (IIPR). This is one of the best-known cannabis REITs and focuses exclusively on medical uses of marijuana. It holds a portfolio of greenhouse buildings that are leased to medical-use growers across major U.S. markets. It offers investors a yield above 2 percent as of September 2021.

While the growth potential of the cannabis industry may sound exciting, there are some key risks to keep in mind.

The cannabis industry is likely to continue to grow in the coming years and investors may look to benefit from that growth through stock ownership or ETFs that track the industry. But remember that innovation doesn’t always lead to profits for shareholders and high-fee ETFs can eat into your ultimate return.

Explore this cbd consumption methods tutorial and follow the step-by-step process to select, use, and verify the safest ways to consume CBD for wellness.

Read More

Learn what CBD edibles are, their main types, expected effects, legal status, safety factors, and how they compare to other forms of CBD.

Read More

Therapeutic Uses of CBD Managing Chronic Pain with CBD Struggling with chronic pain? CBD might help. Studies suggest it can reduce inflammation and alleviate discomfort,...

Read More

Just as CBD may help humans due to its interaction with the body’s endocannabinoid system, the same is true of dogs. CBD has the potential...

Read More

Cannabis has been used for millennia to treat numerous health conditions. Current research offers promising results on the effects of CBD oil on breast cancer.

Read More

What Is CBD for Cats? CBD (Cannabidiol) is a natural compound from hemp. It’s non-psychoactive, meaning your cat won’t get “high.” Instead, it works with...

Read More

1. Understanding Neuropathic Pain Neuropathic pain results from nerve damage or dysfunction, causing symptoms like burning, tingling, or sharp shooting pains. Common Causes: Symptoms Include:...

Read More

CBD for Pets: A Pet Parent’s Guide to Dosage We all want the best for our pets, especially when they’re struggling with pain, anxiety, or...

Read More

What Is Lupus? Lupus is a long-term autoimmune condition that can impact multiple organs, including the skin, heart, lungs, and kidneys. The most common type...

Read More

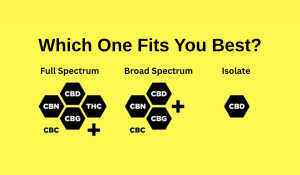

1. Full-Spectrum CBD: The All-In-One Option What it is: Contains CBD, minor cannabinoids, terpenes, flavonoids — and less than 0.3% THC. Why choose it: Promotes...

Read More